Let’s

face it, most people are struggling with their trading. We’ve all been

there, blown accounts, gotten upset over failing, and been left

wondering where it all went wrong. As you replay events over and over in

your head, you eventually ponder to yourself, “What time frame is going

to work best for me?”

Rest assured, you’re not alone. This is a question a lot of traders

are looking to get closure on. If you’ve spent some time checking out

the popular Forex forums, you would have noticed that most traders

gravitate towards scalping or day trading. You probably thought, “Well

if everyone else is doing it, it must be the way to go, right”? Nine

times out of ten, traders are banging their heads in frustration because

they’ve ‘followed the herd’, and ended up using deadly high frequency trading strategies on the low time frames.

When traders come to me and ask me why they aren’t doing so well, I

recommend they make the switch to the daily time frame. Surprisingly,

most are very hesitant to make the switch. The reason the majority of

traders are reluctant to change stems from a few misconceptions of using

the higher charts, like the daily time frame.

Today I am going to cover the most common ‘issues’ traders have with

moving their trading to the daily time frame, and put any concerns you

have to rest.

The daily time frame is too expensive to trade

The first suggestion I make to trouble traders is to try make all

their trading decisions from the daily time frame. The most common

response I recieve back is, “How can you expect me to trade the daily

time frame when I have such a small account?” Too many traders believe

they are restricted to short time frames because of their account size.

The belief that the daily time frame is too expensive to trade flows from the idea – the wider your stop loss, the more expensive the risk.

It’s true your stop loss will be wider when you trade with trade

signals on the daily time frame, but it doesn’t mean you have to risk

any more money than you want to.

Your account size does not restrict you from trading on the daily time frame in any way!

Traders who believe the daily time frame is too expensive to trade,

simply don’t understand how to calculate position size correctly. Lot sizing is calculated mathematically, so you can risk any amount of money into a stop loss of any size.

It’s possible to risk $100 into a 10 pip wide stop, or a 100 pip wide

stop. If you’re on a micro account, you could calculate your position

size accurately to only risk small amounts, like $5 into a 70 pip stop

for example. There is no restriction on what money you risk over what

stop size, it’s just simple mathematics and really should be the bread

and butter of your money management skills.

I won’t bore you by going into all the math here. If you’re serious

about learning how to position your trades on the daily time frame, or

any time frame for that matter, we offer a comprehensive guide to

calculating lot sizes inside our advanced price action course. In the meantime there are plenty of free position size calculators out there which will do the job for you. Like the Babypips position size calculator.

Just so we’re both clear. It doesn’t matter if you have a $10, $100

or $1000 account. You don’t have to miss out on the benefits the daily

time frame offers.

Longer time frames are not as profitable

The majority of traders, especially the newbies, are so focused on

short term charts, because they have no concept of what trading is

really about. Many traders believe if you put in the hours, you will get

the returns. Why do people think like this? Think about it, if you put

in the extra overtime at your day job, and your boss is nice enough, you

will generally be rewarded for your extra enthusiasm and efforts. It’s

crucial you don’t the mistake of trying to integrate real-life logic

into the market, they are a dangerous mix.

The lower time frames will generate more signals, but they are much

lower in quality. While working in an environment like the 5, 15 and 30

minute charts, you’re basically trading ‘market noise’. Granted, the

longer time frames won’t roll out trade setups at such a high pace. But,

the signals that are generated on the daily time frame are much more

reliable, and have a much better chance of working out.

It’s a no brainer, the daily time frame offers more clarity by

providing the ‘bigger picture’. It’s much easier to identify the core

price movements, and peer into the market psychology. Signals on the

daily time frame contain more value as good trading opportunities,

because they contain more price data within the signal. A signal on the

15 minute chart contains a fraction of the data, therefore making it

less reliable.

Signals on the daily time frame generate good follow through with

price movement, allowing for a better chance to hit a 1:3 risk reward on

your trade. A trade setup on the 15 minute chart is at high risk of

being destroyed from the normal day to day volatility.

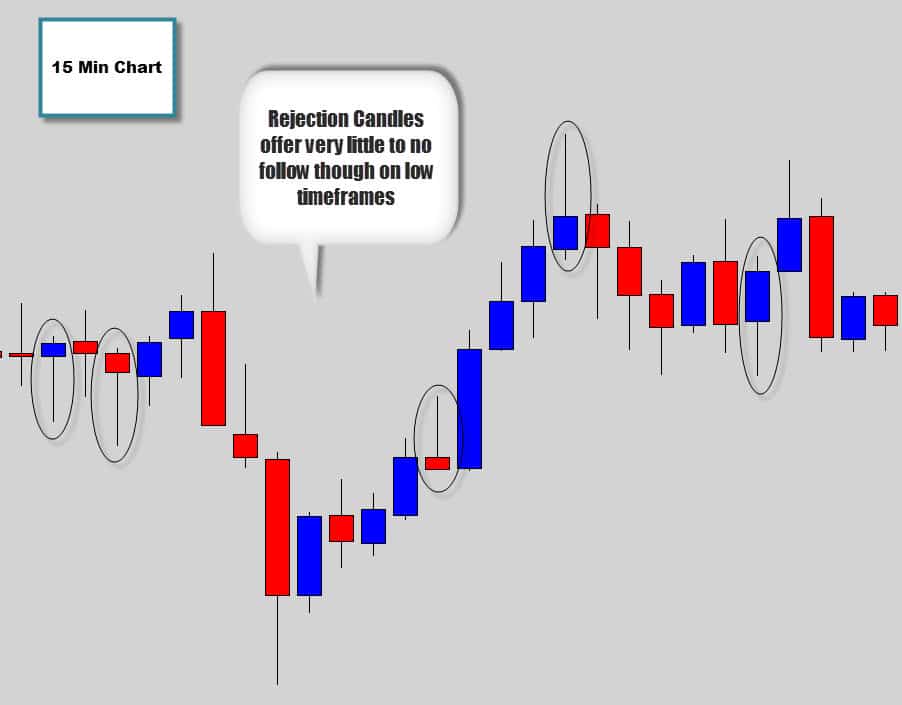

These rejection candles that formed on the 15 minute chart during

typical market conditions offered very little to no price follow

through. These would be very frustrating and not very profitable to

trade.

Now have a look at the daily chart and check out the difference…

The first thing that clearly stands out is the core market direction.

The daily time frame prints this loud and clear whereas the 15 minute

chart was very difficult to determine where the market wanted to go.

Trade signals that formed in line with the dominant movement on the daily chart saw much better price follow through.

The longer YOU’RE in a position the higher the risk

There are traders that will push the idea of being ‘in and out’ of

the market, claiming it is less risky than holding positions on a longer

term. This is built on some bad logic, it generally goes something like

this…

When you enter and exit the market really quickly, you won’t be in danger of being stopped out if the market reverses on you.

Think about it, you’re always going to be at risk of being stopped

out from an unexpected market event, no matter what strategy you use.

The funny thing is, you’re more likely to be stopped out by some

intra-day volatility when you take low time frame setups, and use stop

losses that are tighter than a bee’s backside.

The daily chart filters out this intra-day noise, and provides you

with more reliable data. Most daily time frame setups are unaffected by

the intra-day volatility that knocks the scalpers around. You’ve

instantly gained more of an edge just by working with daily time frame.

Lower time frames require you to be at the computer and monitor price

movements for hours on end. Most short term traders initially love the

‘thrill’ and the ‘action’ the fast pace charts provide, but it’s only a

matter of time before you experience ‘burnout’. Emotions like greed and

fear start to become dominant factors in your trading decisions and put

you in a state of mind where you’re at high risk of spiralling out of

control.

The daily time frame sets you up for success straight away. You spend

a fraction of the time in front of the charts. You’re at less risk of

experiencing ‘trader burnout’ and it’s going to be much easier to keep a

cool head while maintaining your discipline.

Positions are dangerous to hold overnight

This statement is typical day trader’s mentality. “You’ve got to close your position by the end of the day”.

The Forex market is open for 24 hours, 5 days a week. It is fair to say

that holding positions over the weekend can be a little risky due to

unexpected weekend gaps, that’s a completely different topic. There is

no benefit to closing your trades at the end of the day in a continuous

market.

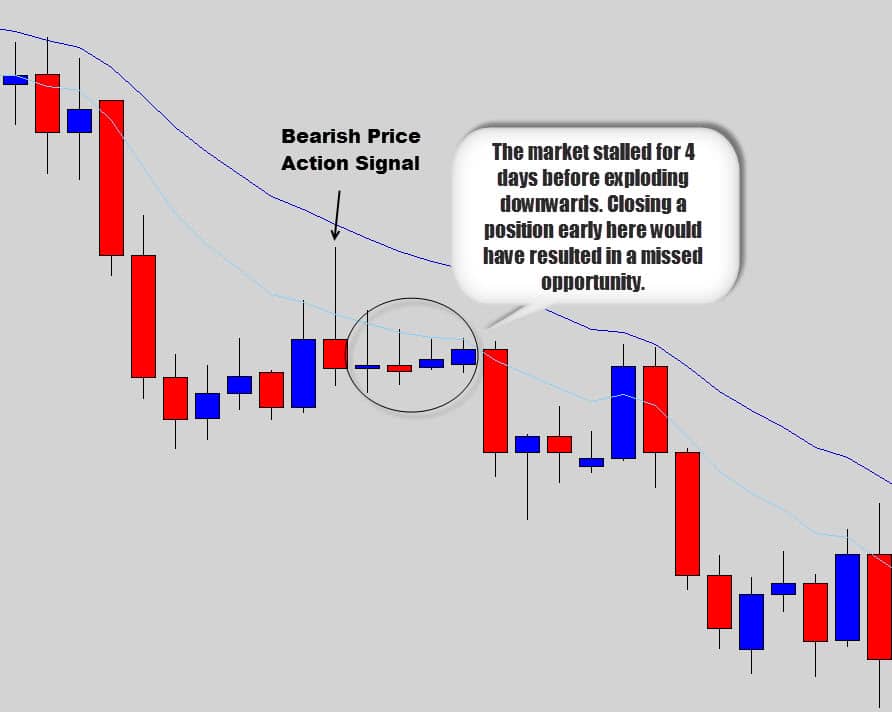

In fact, you could actually be shooting yourself in the foot by

closing off your trades early in this fashion. It’s not uncommon for

trades to take one or two days before you see the ‘breakout’ from the

setup. Have a look at the example trade setup shown below, a bearish

rejection candle on the daily time frame…

This is a good example of why we need to be patient and let the

market do what it needs to do. Closing before the end of the day would

have ensured you were left standing behind, regretting a lost

opportunity.

I know it would be great if you could enter a trade, then price

shoots off and hits your target straight away like a cannonball. The

reality is, some trades may dip into the negative one or two times

before maturing into profit. You need to let your trades have a chance

and give the market the opportunity to do its thing.

Price movements on the daily time frame are hard to predict

This rumour branches from the everlasting argument of technical vs.

fundamental analysis. These days technical trading is considered only

effective for the lower charts and fundamental analysis is for the daily

time frame. Some push the idea that you need to be good with economics

to follow long term movements.

Technical analysis works on the daily chart, in fact it works better

on the daily chart because the daily time frame provides more reliable

data. The noise generated on the lower time frames will distort your

technical analysis and usher you into false signals.

Thanks to the clarity the daily chart brings to your screen, good

trading opportunities are very easy to identify. That’s not generally

the problem, the issue is shifting your focus towards less intense

trading. Large gains that are up for grabs on the daily time frame can

work to change a struggling intra-day scalper into a calm swing trader.

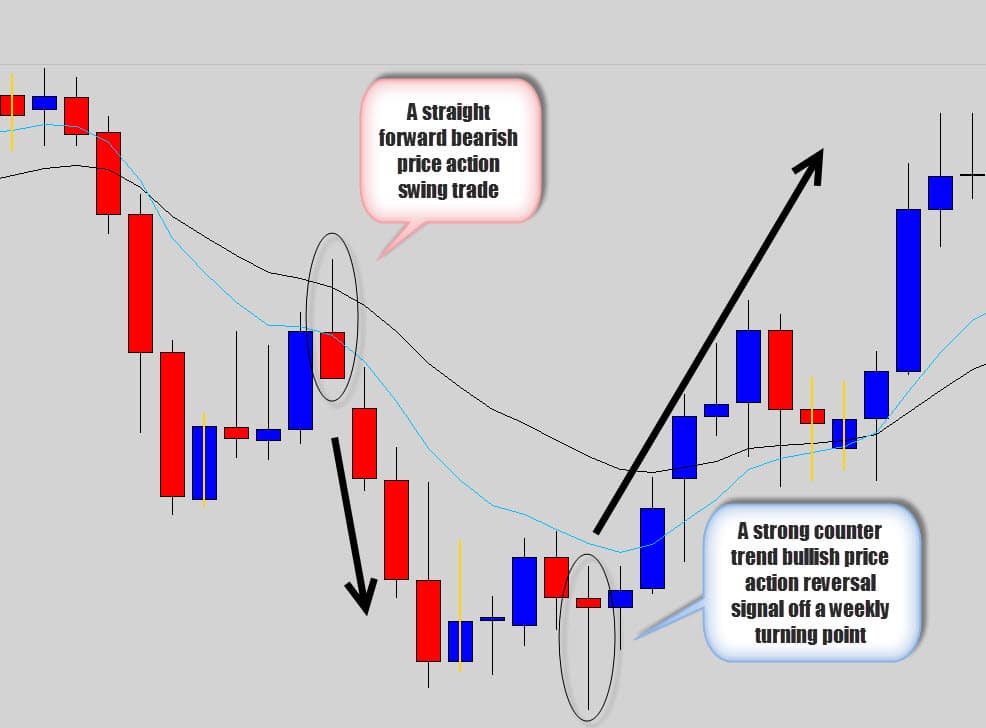

Take a look at the example below…

The examples of the price action signals above are good examples of

how easy it can be to anticipate future price movements using simple

technical trading signals. Myself and many of the other War Room traders

jumped on board both of these price action setups. The simplicity of

these kind of setups is one of the major benefits of price action.

It’s time to stop chasing ghosts on the 15 minute chart and start

trading the right way. Just by switching over to the daily time frame

you’re making necessary corrections to begin paving the way to trading

success.

The daily time frame requires less time, provides a clearer picture

of the market and allows you to be more objective. The reduction in

screen time puts you at less risk of becoming mentally or emotionally

unstable and give you the opportunity to enter trade setups that yield greater returns. Get it out of you head that more work equals more money.

If you would like to learn how to trade the lazy way by taking

advantage of all the benefits the daily chart offers. Check out our price action trading course, we teach how to combine price action strategies with the daily charts in a stress free way that will fit into your busy life.

I hope you found this article useful and can now see how beneficial

making the switch to the larger time frames can be. Why not tell your

friends about it too by clicking one of the buttons below? They’ll thank

you for it… trust me!